Understanding the fundamentals of insurance coverage can seem to be a tiny bit daunting to start with. After all, coverage is one of those matters we regularly just take with no consideration till we want it most. But the truth is, using a stable understanding of how insurance policies functions is important for any person looking to protect by themselves, their family members, and their property. No matter if you’re pondering car or truck insurance, wellness insurance policies, or residence coverage, the basics of insurance policies are more related than you may think.

At its core, insurance plan is all about risk administration. To put it simply, it’s a method to transfer the economical chance of unforeseen functions, for instance incidents, disease, or injury, to a larger entity—like an insurance company. By having to pay a comparatively little quantity (referred to as a quality), you can stay away from the large economic load That may feature A serious event. It’s a bit like purchasing satisfaction, figuring out that if some thing goes Improper, you received’t be left with your entire Expense.

Amongst The key components of comprehension the basic principles of insurance policy is grasping the concept of rates. A high quality is the quantity you spend for your insurance company in exchange for coverage. It’s like leasing a stability blanket—while you fork out an everyday price, the corporation assumes the economical threat. Premiums can vary based upon many elements, including the style of coverage, your age, your health and fitness, as well as your credit rating. And whilst premiums might seem like a small selling price to pay, they might insert up eventually, so it’s vital that you store close to and get the ideal offer.

The Single Strategy To Use For Understanding The Basics Of Insurance

An additional crucial thought in understanding insurance plan could be the deductible. The deductible is definitely the amount of money you’ll really need to pay out out-of-pocket before your insurance protection kicks in. For example, if you have a $500 deductible on your vehicle insurance policies coverage and you also get into an accident that expenses $three,000 to maintenance, you’ll need to pay the first $500, as well as insurance provider will deal with the remaining $two,500. Deductibles can vary widely depending upon the plan, and in some cases, it is possible to alter the deductible to decrease your premiums.

An additional crucial thought in understanding insurance plan could be the deductible. The deductible is definitely the amount of money you’ll really need to pay out out-of-pocket before your insurance protection kicks in. For example, if you have a $500 deductible on your vehicle insurance policies coverage and you also get into an accident that expenses $three,000 to maintenance, you’ll need to pay the first $500, as well as insurance provider will deal with the remaining $two,500. Deductibles can vary widely depending upon the plan, and in some cases, it is possible to alter the deductible to decrease your premiums.Now, Permit’s discuss what transpires when some thing goes Completely wrong. This is when statements come into Participate in. A declare is basically a ask for to the insurance provider to deal with The prices of an event that’s been protected below your policy. No matter if it’s an auto incident, a clinical unexpected emergency, or even a property fireplace, you’ll file a claim to receive compensation with the harm. The entire process of submitting a declare could be diverse for every type of insurance coverage, but it surely frequently entails publishing a report on the incident, as well as any supporting documentation, like police reports or professional medical expenses.

At the time your declare is submitted, the insurance provider will evaluate the situation and identify whether or not they pays out the declare. This is when the notion of protection limitations will come into Engage in. Protection limitations make reference to the utmost sum of money an insurance company pays out for a certain style of assert. For illustration, if you have a home insurance coverage plan which has a $200,000 coverage limit for fireplace hurt, and the cost to rebuild the house after a fire is $250,000, you’ll be left which has a $50,000 hole to cover on your own.

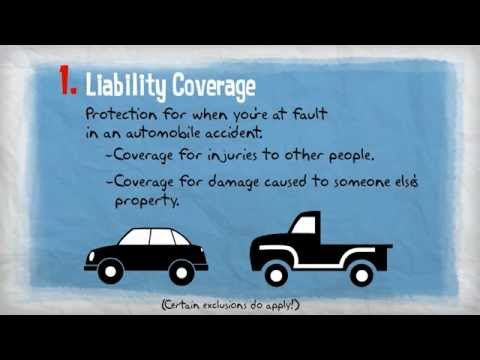

Understanding the basics of insurance policies also implies understanding the different sorts of insurance available to you. There’s overall health coverage, which aids cover the price of healthcare treatment; auto insurance policies, which safeguards you monetarily in case of an automobile incident; life insurance, which provides economical assistance towards your family and friends When you move away; and home insurance, which handles harm to your assets. Just about every of most of these insurance coverage has its individual list of policies and rules, but the final principle is identical: to safeguard you from fiscal hardship in the occasion of sudden incidents.

As you start to dive deeper into the entire world of insurance coverage, you’ll encounter conditions like exclusions and riders. Exclusions confer with situations or conditions that aren’t covered by your coverage. For example, When you have automobile insurance policies, there is likely to be an exclusion for harm due to driving underneath the influence of Alcoholic beverages. Riders, On the flip side, are add-ons that give further protection for distinct requirements. For instance, If you prefer further security for worthwhile jewelry, you'll be able to incorporate a rider to your own home coverage plan to address that specific item.

It’s also worth noting that there are various levels of protection accessible in insurance plan insurance policies. By way of example, with well being insurance, it is possible to choose from unique options with varying amounts of coverage, from essential to in depth. The greater in depth the protection, the upper the quality, but you’ll also have a broader basic safety Web set up. This is when knowledge your own personal requires arrives into Enjoy—you need to ensure that you’re receiving the suitable quantity of protection on your condition, with out overpaying for things you don’t have to have.

The 20-Second Trick For Understanding The Basics Of Insurance

Danger assessment is another significant Component of knowing the basic principles of insurance policies. Insurance coverage companies count closely on information to evaluate the level of possibility connected with furnishing protection. They give the impression of being at factors like your age, your driving background, or your wellbeing standing to ascertain how probably it is you’ll ought to file a claim. According to this evaluation, they established your premiums. For example, When you have a history of incidents, you may perhaps spend an increased quality for auto insurance plan since the insurer sees you as an increased threat.But insurance coverage isn’t just for people—it’s also essential for enterprises. Business coverage is designed to protect providers from fiscal losses due to incidents, lawsuits, or other unexpected occasions. Such as, if a purchaser slips and falls in your retail store, legal responsibility coverage might help deal with the lawful fees and any settlements. Likewise, house coverage may help cover the price of repairing or changing destroyed tools or stock. Organizations will need to know the basic principles of insurance just up to people do to make certain they've the correct defense set up.

Among The most crucial facets of coverage is being familiar with the relationship amongst danger and reward. In other words, you pay out rates in Trade for the potential of acquiring a payout inside the party of a included incident. The insurance company, consequently, takes about the money danger. It’s a balance in between That which you’re prepared to pay back now as well as the protection you’re hoping to obtain Down the road. This is often why it’s so vital that you overview your plan often and make sure it even now satisfies your requirements as your daily life changes.

In terms of knowledge the basic principles of insurance policies, Probably the most missed facets is the fine print. Guidelines may be very long and complicated, but it really’s important to go through by way of them diligently right before signing to the dotted line. Many insurance coverage corporations check out to hide significant information in the great print, for example exclusions or ailments that would influence your coverage. By knowing the stipulations of the plan, you may prevent surprises when it’s time to file a claim.

Of course, no dialogue about insurance policies is total without talking about the value of procuring all around. Not all insurance coverage policies are created equal, and The ultimate way to Find Answers ensure you’re obtaining the proper coverage at the ideal selling price is by evaluating various choices. There are several on the internet equipment and resources accessible which will help you Evaluate offers from diverse insurance coverage businesses, making it possible for you to definitely discover the policy that best suits your preferences and finances. It’s slightly like dating—you might have to kiss some frogs before you decide to uncover your ideal match, but it surely’s worth the hassle.